What Every Real Property Investor Should Know

Investing in the actual property market may be an intimidating prospect. Nevertheless, with the right data, it can also be profitable. Assume You'll Achieve success In The actual Estate Market? Try The following tips First accommodates some ideas to help direct you. Use this data as a platform. The extra you already know, the more doubtless you might be to succeed in the sort of funding.

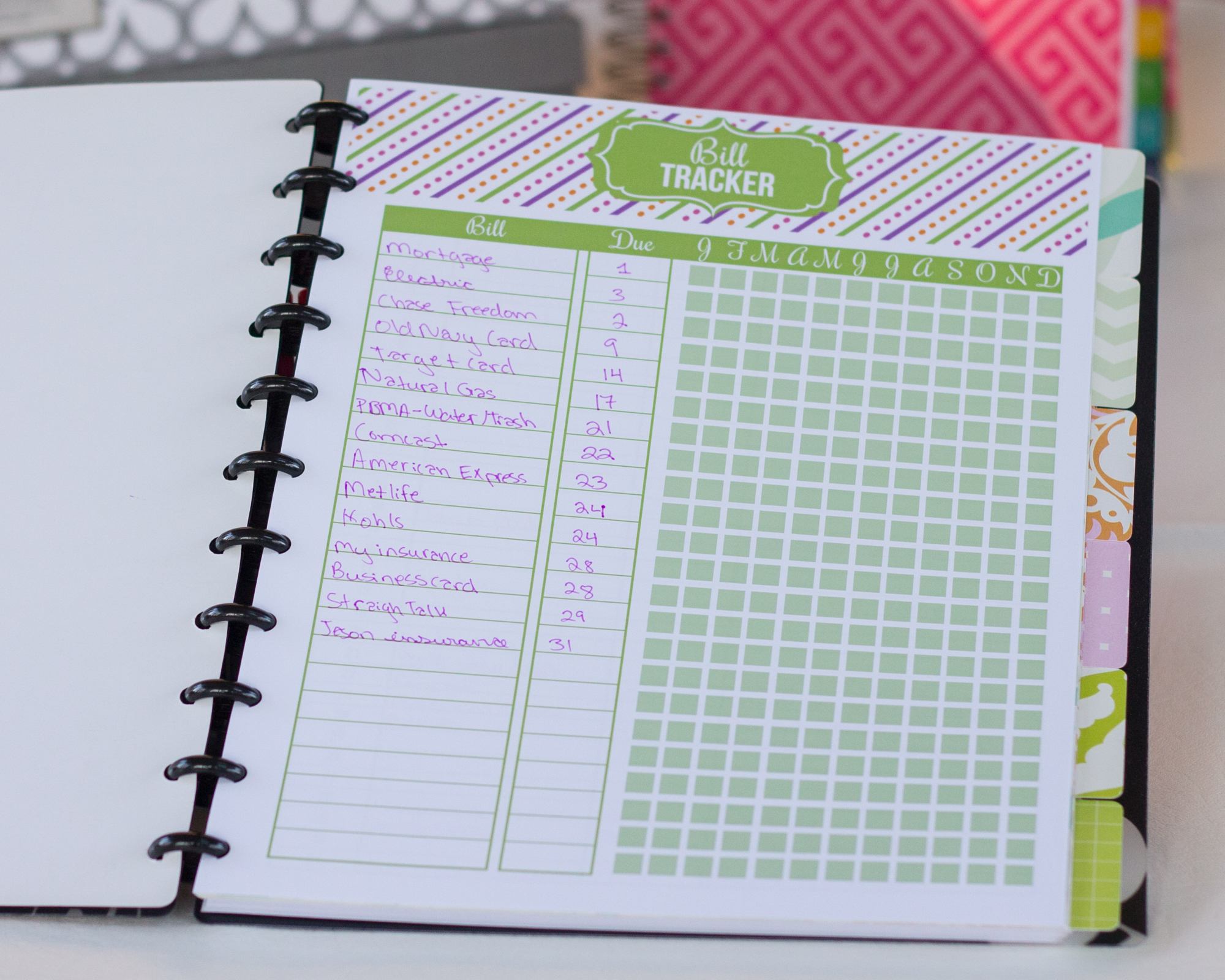

Earlier than investing in real property, attempt analyzing the market and researching completely. Have a spreadsheet useful as you take a look at as much as a hundred properties around the area by which you intend to invest. Individual facets you want to note are market costs, rent expectations and renovation prices. You'll simply see which properties are good investments and which aren't.

If you are already a homeowner or have expertise as one, consider beginning your real estate funding efforts with residential properties. This area is already something you know about, and you can start good funding habits. As soon as you're comfortably making secure money right here you possibly can transfer on to the barely completely different world of commercial actual property funding.

Have a number of exit strategies for a property. A number of things can affect the value of real property, so you're finest having a short time period, mid-time period, and long run strategy in place. That manner you may take motion based mostly off of how the market is faring. Having no quick time period resolution can value you a ton of cash if issues go awry rapidly.

In the event you plan to do any physical upgrades to an investment property, you must never dig in the ground round it till you have talked to an professional to see the place the traces are buried around it. It is unlawful to dig in some areas.

Don't go too far into your personal finances on your investments. Understand that whenever you put money into real property, your cash will not be readily out there. This can be a state of affairs that would go on for numerous years. Don't let this case destroy your skill to dwell from at some point to the next.

Do your analysis previous to investing in actual property. The town should have an official website. You could find details relating to city planning that might affect how costs in actual property go. Cities or areas which might be experiencing economic development are likely to yield a very good revenue for you.

Know that you just want an excellent group to get entangled in real property investing. At The primary Things To bear in mind About Investing , you want a Realtor, accountant and a lawyer you can all trust. You may even want an investor or a social gathering of fellow buyers. Attain out by way of your private connections to seek out people who won't allow you to down.

You want to contemplate the worst case scenario if you have been unable to promote a property you had been invested in. May you rent it or re-function it, or would it be a drain in your finances? Do you've got options for that property so that you can have a back up plan if you cannot promote it?

When investing in real estate in right now's world, it's necessary to take discover of "green" options within a house. Today's perception of the "worth" of these types of modifications is trending ahead, so this can affect future transactions immensely regarding the properties you buy, whether you rent or sell.

If you do not know what you are doing, it could cost you a ton of cash. That is why it is best to hunt down the help of an experienced professional. Although this will cost cash, it will provide you with peace of thoughts as you head into the unknown.

Convey a contractor with you once you check out a possible investment property. A contractor can give you an idea of any essential repairs, as well as the fee to do those repairs. This may enable you to to resolve on what sort of supply to make, do you have to resolve to buy.

It doesn't matter what occurs in the market, remain calm. It'll go up and down. In the event you get overly excited each time it goes up, and overly depressed each time it goes down, you might be rather more more likely to make poor, impulsive selections. If you must, communicate to an goal outsider who can offer you perspective if your nerves are taking over.

Diversify your investments. Relying on the situation, some might do higher than others. One example is that the costs of bonds usually lower when curiosity rates improve. What You could Learn about Investing to contemplate is that some industries prosper whereas others battle. You possibly can reduce your risk by investing in different kinds of investment options.

Don't be blinded by anybody's promise of making you wealthy in a single day in case you spend money on his schemes. Normally, individuals like this requires your cash upfront whereas promising you nice returns. Too many people have been burned by guarantees like this. Avoid these guarantees, and simply persist with tried and true methods to speculate.

Set real looking expectations. Don't expect that every funding will dwell as much as the hype or the most effective case situation. Do not count on that you will have the identical positive factors as the person who made it massive of their first yr of investing. Set realistic goals and expectations for the investments and you will not be dissatisfied.

Steadiness an aggressive strategy with widespread sense. Your essential focus with investing is your money. Which means not shedding The top Investment Recommendation You'll Ever Learn of your sources or your strategies. A scarcity of focus on your plan will end in a scarcity of money. Danger is okay, however don't gamble with cash that is not obtainable.

When investing in stocks, be sure that to purchase stocks in firms which are ran well. Many occasions firms can grow to be unfavorable to investors attributable to unhealthy publicity or a lackluster business. These can nonetheless be bargains if you happen to oay consideration to the basics of the business and look for firms which can be nicely managed.

You want not be overwhelmed or frightened of the true estate market. Knowledge will assist you in making sound choices. This text had an important deal of good information to start out with. When you understand how actual property works, you'll become extra comfy with it. Then, you may be on your way to success.